Proposed Rates

2024/2025 Rating Proposal

You can review the 2024/2025 Rating Proposal via the link below:

Rating Proposal - 2024/2025

Notice of Intention to Levy Differential Rates 2024/2025 Financial Year

Additional Rating and Valuation Information

Rates are a primary source of revenue for the City of Busselton (City) and are imposed on all rateable land within its district so as to provide revenue to fund the services and facilities provided to residents, local businesses and visitors.

A single general rate may be imposed on rateable land that has a Gross Rental Value (GRV) or Unimproved Value (UV) type. Alternatively, the City can distinguish between land with either value type on the basis of its use, zoning or whether it is vacant land (or other characteristic set out in regulations), or a combination of these factors and apply a differential rate.

For the 2024/25 financial year, the City intends to continue to use differential rates to raise rate revenue with a proposed average 7.00% increase to the rate in the dollar and minimum payment for all differential rating categories except for Holiday Homes, which will have an average 15.12% increase.

The average 7.00% increase considers current cost factors, ongoing asset management demands, and the impact of lower than CPI rating over the past four years, including a 0% increase in 2020/2021 due to impacts of COVID.

For holiday homes, the State Government Short Term Rental Accommodation reforms will replace the City’s own registration scheme, under which fees are payable to support management and compliance of holiday homes. These functions will continue to be the responsibility of the City and therefore the City is proposing a higher differential rate for holiday homes.

All rateable land will have either a GRV valuation, for land that is predominantly used for non-rural purposes, or a UV valuation for land that is predominantly used for rural purposes. These valuations are provided by the Valuer General in accordance with the Valuation of Land Act 1978 and are usually revalued every 3 years for GRV and yearly for UV values.

There has been a revaluation of all UV’s values effective from 1 July 2024. The increase in UV’s have been taken into consideration as best as possible when setting the 2024/25 rate in the dollar for each UV differential rating category. If a property’s UV has increased above the average, then this property’s rate increase will more than likely be higher than the intended average increase. This is because a rate in the dollar under the Local Government Act 1995 (LGA) must be applied to all properties within a differential rating category, and not individually property by property.

If there are any queries in relation to a property’s valuation, please refer to the VGO website at www.landgate.wa.gov.au/valuations or call their customer service on (08) 9273 7373 for more information.

Proposed Differential Rates

It is proposed for the 2024/25 financial year that the following rate in the dollar and minimum payment for each differential rating category will apply:

|

Differential Rate

|

Rate in the $

|

Minimum Payment

|

|

GROSS RENTAL VALUATION PROPERTIES

|

|

Residential – Improved & Vacant

|

$0.091300

|

$1,623

|

|

Commercial - Improved & Vacant

|

$0.120076

|

$1,623

|

|

Industrial - Improved & Vacant

|

$0.127838

|

$1,623

|

|

GRV Holiday Home

|

$0.109149

|

$1,814

|

|

UNIMPROVED VALUATION PROPERTIES

|

|

Primary Production

|

$0.003252

|

$1,623

|

|

UV Commercial

|

$0.005941

|

$1,623

|

|

UV Rural

|

$0.003058

|

$1,771

|

|

UV Holiday Home

|

$0.003235

|

$2,097

|

(**NOTE: Council when adopting the annual budget may vary the above proposed rate in the dollar.)

Other Yearly Charges, Fees and Levies

All yearly charges, fees and levies are clearly outlined on your Rate Notice and may include:

Specified Area Proposed Rate in Dollar

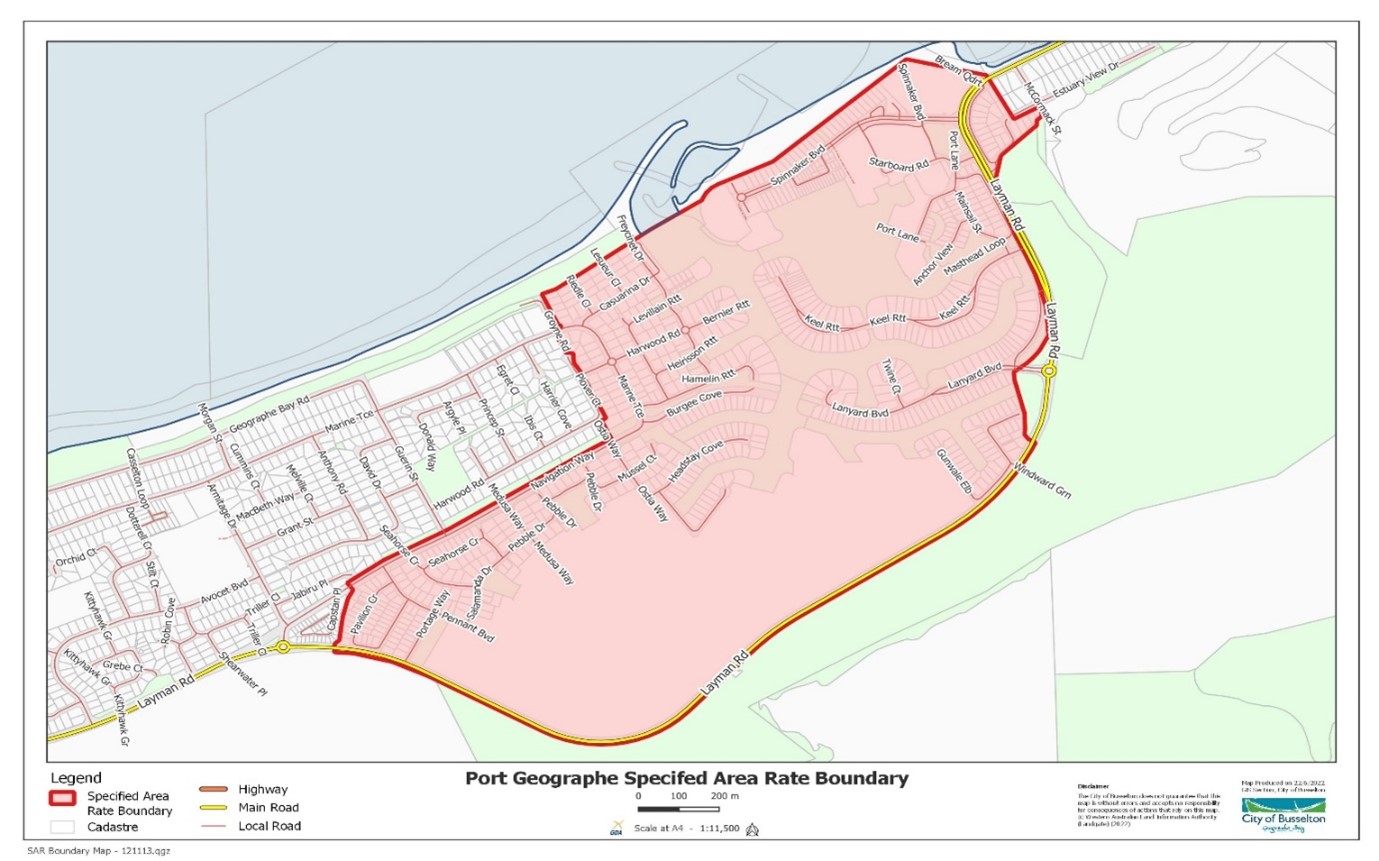

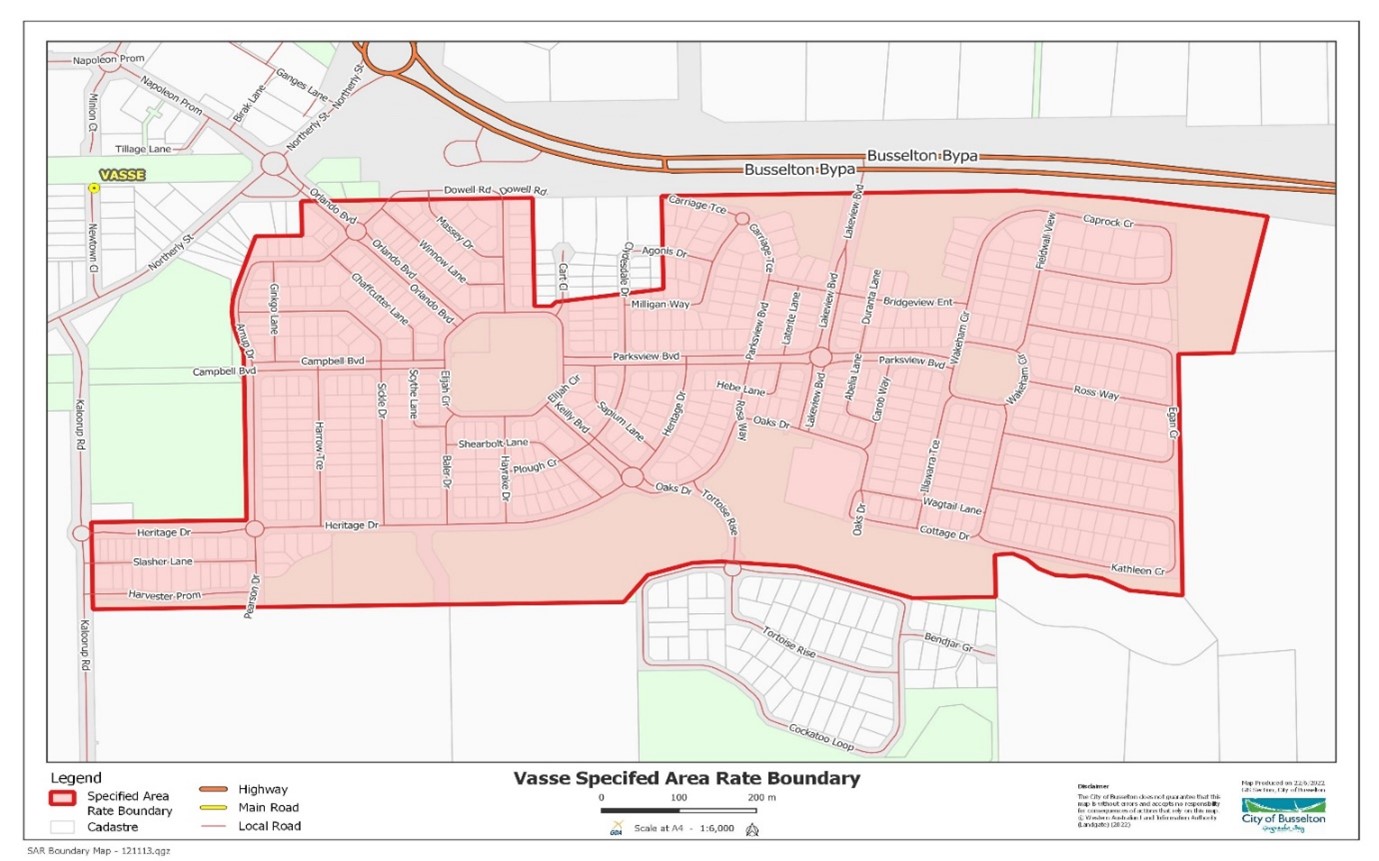

It is proposed for the 2024/25 financial year that the following rate in the dollar will apply for the Specified Area’s as per the below maps:

|

Specified Area

|

Rate in the $

|

|

GROSS RENTAL VALUATION PROPERTIES

|

|

PORT GEOGRAPHE

To all properties within the area known as Port Geographe, in order to meet the obligations of the City under the Port Geographe Management Deed. The rate is applied to all properties within the area of former Town Planning Scheme No. 19 based upon a property’s Gross Rental Value.

|

$0.014439

|

|

PROVENCE

To all properties within the area known as the Provence Subdivision (Busselton Airport North), in order to hold funds for the maintenance of the approved higher standard of landscaping within the Provence subdivision in accordance with Council resolution C0806/172.

|

$0.13172

|

|

VASSE

To all properties within the area known as the Vasse (Birchfields) Subdivision, in order to hold funds for the maintenance of the approved higher standard of landscaping within the Vasse (Birchfields) subdivision in accordance with Council resolution C0806/173.

|

$0.01634

|

|

UNIMPROVED VALUATION PROPERTIES

|

|

PROVENCE

To all properties within the area known as the Provence Subdivision (Busselton Airport North), in order to hold funds for the maintenance of the approved higher standard of landscaping within the Provence subdivision in accordance with Council resolution C0806/172.

|

$0.000139

|

(**NOTE: Council when adopting the annual budget may vary the above proposed rate in the dollar.)

Waste Infrastructure Rate

A rate in the dollar is levied to fund significant waste infrastructure development and boost recycling activities to reduce landfill. The rates in the dollar are:

- Unimproved Valuations – Rate in Dollar $0.000004; Minimum Rate - $100

- Gross Rental Valuations – Rate in Dollar $0.00001; Minimum Rate - $100

Swimming Pool Fee

Charged per annum for properties that have on them a swimming pool, for an approved Council officer to inspect the safety requirements.

State Government Emergency Services Levy (ESL)

The Emergency Services Levy (ESL) is a compulsory State Government levy which is forwarded to the Department of Fire and Emergency Services (DFES) to fund services such as fire and rescue services, bush fire brigades and state emergency services throughout Western Australia.

The State Government has determined that there will be an increase between 3.48% and 5.10%. For further information please refer to the DFES website at or call 1300 136 099.

Did you know?

The Emergency Services Levy (ESL) funds Western Australia’s (WA) fire and emergency services, including Career and Volunteer Fire and Rescue Service brigades, Volunteer Fire and Emergency Service units, bushfire fighting and management services.

Objects and Reasons for Differential Rates

Differential Rates – Gross Rental Valuations (GRV)

Residential (Vacant/Improved)

The object of this category is to apply a differential general rate or minimum payment to land used or held or zoned for residential purposes. And to act as the City’s benchmark differential rate and minimum payment by which all other GRV rated properties are assessed.

The reason for this rate is to ensure that all ratepayers make a reasonable contribution towards the ongoing maintenance of public assets, infrastructure and facilities, as well the provision of community services throughout the district.

GRV Holiday Homes

The object of this category is to apply a differential rate or minimum payment to land with a Gross Rental Value that is wholly or partly used or held or zoned for Holiday Home purposes.

The reasons for this rate, which is over and above that for ordinary Residential mentioned above, is to assist with the funding of Tourism, Marketing, Events and Economic Development related projects, activities and services throughout the district.

Commercial (Improved/Vacant)

The object of this category is to apply a differential rate or minimum payment to land wholly or partly used or held or zoned for Commercial purposes.

The reason for this rate is in order to assist with the funding of Tourism, Marketing, Events and Economic Development related projects, activities and services throughout the district.

Commercial/Industrial (Vacant/Improved)

The object of this category is to apply a differential rate or minimum payment to land wholly or partly used or held or zoned for Commercial and Industrial purposes.

The reason for this rate is to assist with the funding of Tourism, Marketing, Events and Economic Development related projects, activities and services throughout the district.

Differential Rates – Unimproved Valuations (UV)

Primary Production

The object of this category is to apply a differential general rate or minimum payment to land used or held or zoned for bona-fide primary production and is to act as the City’s benchmark differential rate by which all other UV rated properties are assessed.

The reason for this rate is to ensure that all ratepayers make a reasonable contribution towards the ongoing maintenance of public assets, infrastructure and facilities, as well the provision of community services throughout the district.

UV Rural

The object of this category is to apply a differential rate or minimum payment to land used or held or zoned for non-primary production or non-commercial purposes.

The reason for this rate is to acknowledge that the majority of properties in this category are typically of a rural residential nature and that the level of rating should be more reflective of such use.

UV Holiday Home

The object of this category is to apply a differential rate or minimum payment to land with an Unimproved Value that is wholly or partly used or held or zoned for Holiday Home purposes.

The reason for this rate is to assist with the funding of Tourism, Marketing, Events and Economic Development related projects, activities and services throughout the district.

UV Commercial

The object of this category is to apply a differential rate or minimum payment to land with an Unimproved Value that is wholly or partly used or held or zoned for commercial purposes.

The reason for this rate is to assist with the funding of Tourism, Marketing, Events and Economic Development related projects, activities and services throughout the district, and to achieve a fair and equitable level of rating between commercial properties within both the UV and GRV differential rating categories.