Budget 2024-2025

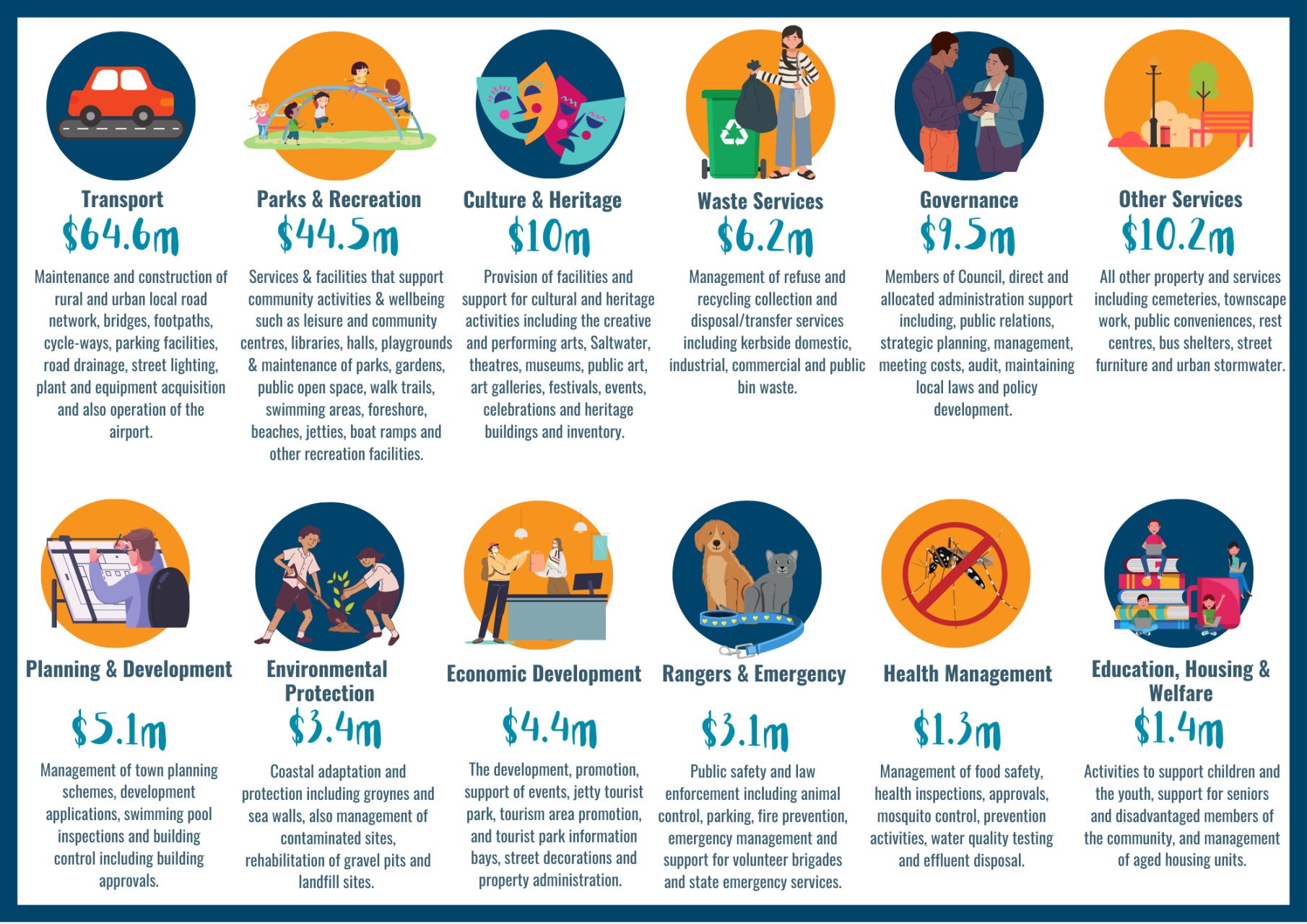

The City of Busselton adopted the 2024-2025 Annual Budget at a Special Council Meeting on 31 July 2024 – providing for $163.9 million of operational and capital investment (inclusive of depreciation) across a range of services, facilities and projects that are important to our key strategic themes - natural environment, lifestyle and the creation of opportunities across the City.

The City’s budget allows for the continued investment in everyday community services and facilities we all use - safe roads, footpaths and cycleways, vibrant parks and playgrounds, sporting facilities, waste management, youth and leisure services, community safety and much more. This is what makes the City a great place to live, work and raise a family.

Annual Budget 2024-2025

Annual Budget Executive Summary 2024-2025

Budget Highlights

Figures represent both operational and capital works funding streams from the 2024-2025 Budget (inclusive of depreciation). Numbers have been rounded for accessibility.

Capital Works 2024-2025

We continue to invest in the maintenance of our substantial asset base and have committed $53.2 million for capital works to meet our growing community’s needs. This includes $10.2 million in respect of the City’s road network, comprising of renewal works on Commonage Road Dunsborough and the reconstruction and widening of North Jindong Road, and an investment of $3 million into footpaths and cycle ways.

Through the capital works program $14.5 million will be invested in buildings, including the carry over of Saltwater funding and funding for the Dunsborough Lakes Sporting Pavilion.

A further $5.1 million will be invested in recreation and reserves, including replacement and renewal of playground equipment in multiple locations and lighting renewal at the Dunsborough Oval and Skate Park. $3.3 million will further enhance the Busselton Regional Airport works, including $1.2 million to expand the public car park.

This is just some of what’s to come for the City of Busselton over the next 12 months.

FAQs

How does the City prepare its annual budget?

Council is guided by a number of strategy documents, such as the Strategic Community Plan, to ensure City expenditure is aligned with community priorities.

We first review our operating costs, taking into account any external cost increases and look at how we can implement efficiencies. We also look at our asset management needs and what we need to provision for in the future.

Available funding sources for the financial year ahead, include:

- Grants

- Reserves

- Fees and charges

- Interest revenue

- Loans

- State and federal government funding

- Rates

We always aim to keep rate increases to a minimum, but as costs to keep the City running rise, modest rate increases are needed to support the growth and maintenance of our large City. From major infrastructure projects to keeping our neighbourhoods clean, green and tidy, our budget provides facilities and services we can all use every day. The budget also includes funding to support the success of our local sporting clubs, community groups, not-for-profit service providers and local businesses.

How does the City decide on the amount of rates income required?

Required rates income is determined by forecasting the amount of money needed for the infrastructure and the services and facilities our community relies on and expects.

City income is not generated through rates alone. We take into account a combination of income streams, including State and Federal government funding, reserves, income generated from fees and charges and interest revenue.

How does the City calculate my rates?

Please visit our Rates FAQ page which will you give all the information around rates.

Rates FAQs

Related Information

Media Release - Annual Budget 2024-2025

Annual Budgets and Schedule of Fees and Charges